If you want to import small shipments to the United States without paying duties or taxes, you should learn how to use the Section 321 program effectively.

What is Section 321?

19 U.S.C. § 1321(a)(2)(c) of the Tariff Act of 1930, more commonly known as Section 321, allows for merchandise with an aggregate value under $800 to be exempted from all duties and importation taxes by U.S. Customs Border & Protection (CBP). For example, a shipment worth $790 and a shipment worth $200 would both qualify for Section 321. The purpose of this section is to lighten the load for the CBP when it comes to small packages, especially with the rise of e-commerce. This is why Section 321 is also known as "de minimis" which is Latin for when something is too small to consider.

What is Entry Type "86"?

On September 28, 2019, CBP is conducting a voluntary test of Section 321 de mini-mis commercial entry process through the new Entry type "86", which allows customs brokers and self-filers to electronically submit de minimis entries through ABI, including those subject to PGA data requirements for clearance.

Who qualifies for Section 321?

CBP ruled that the "person" considered for Section 321 eligibility is the consignee (likely the U.S. fulfillment facility, warehouse taking custody of the merchandise) by default, although the owner (likely the foreign seller) or the purchaser of the merchandise may qualify for Section 321 if their identity is presented to the CBP. For instructions on how to submit the identity of the owner or purchaser, please view this announcement from the CBP. This statute and ruling are intended to help CBP manage and inspect small packages while benefiting the public.

How do I use Section 321 to my advantage?

Section 321 is most often used in Delivery Duty Paid (DDP) shipments by foreign sellers in e-commerce where shipments tend to be smaller.

If you are the foreign seller of the shipment, then you can use Section 321 to be exempted from duties and importing taxes if you are responsible for the shipment.

If you are the purchaser, Section 321 may lower your cost for DDP shipping if you are ordering small goods (such as in the case of online shopping).

Overall, if you are importing any goods that value under $800, be sure to use Section 321.

Please note that Section 321 is only applied for any shipment imported by one person on one day having a fair retail value in the country of shipment not exceeding $800.

Precautions with Section 321

Please note that as long as the value of your goods is under $800, you will be exempted from all duties and import-related taxes. Do not submit a false lower value for your goods. Doing so falls under submitting false or misleading information and may result in fines ($10,000 or more) and/or imprisonment (5 years or more) even if the true value of your goods would have qualified for Section 321.

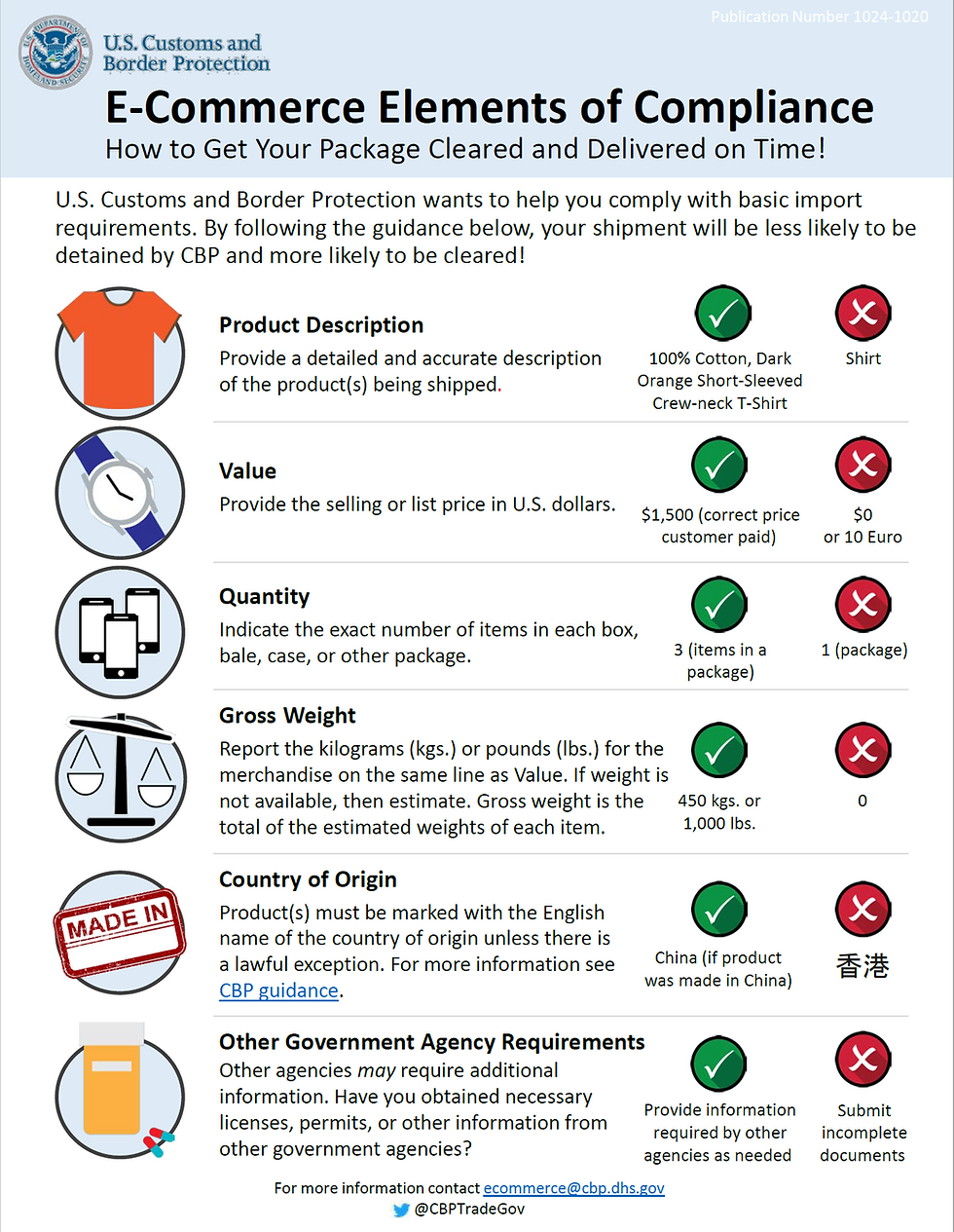

Additionally, declaring Section 321 for a shipment does not exempt it from inspection by the CBP. Always comply with basic import requirements. Otherwise, your shipment may not be cleared by the CBP. Below is an infographic from the CBP on what information.

Also, do not use Section 321 to import counterfeit goods. Importing counterfeit goods to the U.S. is illegal. One way to avoid accidentally importing counterfeit goods is to not import name brands (like Coach, LV, etc.) under Section 321. Name brand goods often value more than $800 meaning if you have a name brand good that values under $800, it is most likely a counterfeit. The CBP is also more likely to inspect name brand goods imported under Section 321. Below is an infographic by the CBP showing the consequences of importing counterfeit goods.

To learn more about Section 321 and Entry Type "86", please view this page from the CBP

or

call us at 714-738-1196 or email us at Customsbroker@spiritchbinc.com if you have any more questions.

Comments